HBL Power Systems, incorporated in the year 1977, is one of the most well-reputed companies in India’s power and energy sector. And from being only into batteries and electronics, the organization has grown into a diversified engineering and manufacturing organization, with strength in various power systems mainly at high sectors such as defense, aerospace, and railways. HBL Power Systems is a quality-conscious innovator that makes it an interesting stock for investors following the development of India’s industrial and energy landscape.

Company Overview

HBL Power Systems is involved in the following businesses:

Batteries: The company manufactures and offers lead-acid, nickel-cadmium, and lithium-ion batteries across a broad spectrum of industries.

Power Electronics This includes battery chargers, inverters, UPS systems, and power management solutions.

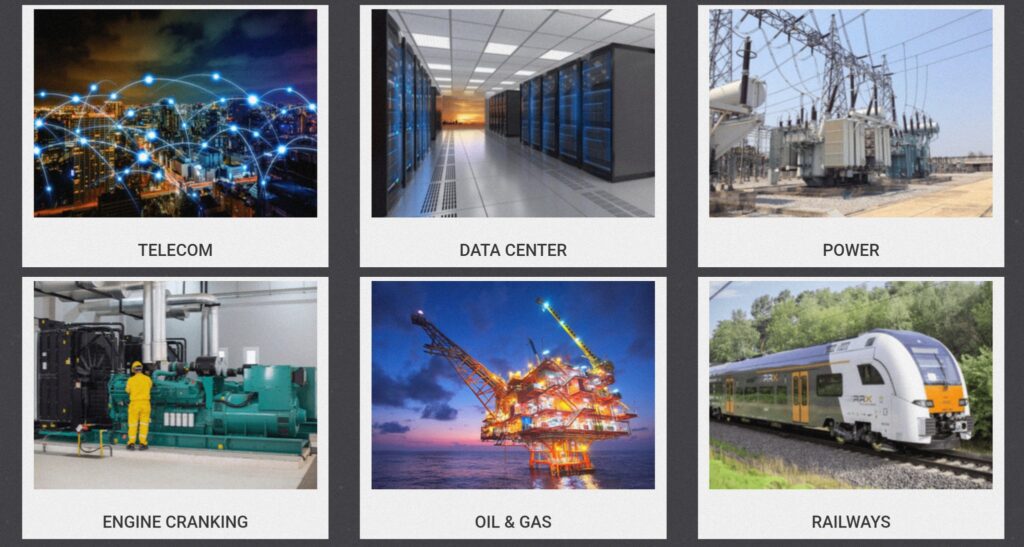

Engineering Solutions: HBL extends its engineering solutions into the defense, telecom, railways, and the energy sectors.

Railways and Defence: The high-performing, specialist batteries as well as power solutions are trusted suppliers by India’s Ministry of Defence and Railways in specialized batteries.

In such highly critical mission applications, reliability becomes paramount, and the company’s products have been critical in such applications. From uninterrupted power supply to telecommunication networks to India’s energy solution for its defense, it is here that HBL has been established as a leader-company because of its total focus on quality and durability in such highly demanding sectors.

Product Line and Innovation

HBL Power Systems has a very diversified product portfolio, essentially representing innovation and R&D capabilities. HBL’s product lines are:

Lead-Acid Batteries : HBL’s lead-acid batteries are in VRLA as well as in tubular form, and constitutes the back bone of power backup and renewable energy systems.

Nickel-Cadmium Batteries: The major applications of these batteries lie in railway, aviation, and industries mainly based on reliability against high temperatures.

Lithium-Ion Batteries: As the world market in energy storage is fast switching over to lithium-ion technology, HBL is also keeping pace with offerings for telecom, solar power, and EV markets.

Power Management: This product segment of HBL provides products, such as DC-DC converters, battery management systems, and inverters, among others.

In addition, through sustainable and energy-efficient products, HBL has also sought renewable energy solutions. Its investments in R&D lithium-ion technology and investments in the domain of energy storage systems make HBL a significant contender in the rapidly evolving clean energy market of India.

ALSO READ :

https://samacharpatrika24.com/pranav-mohanlal-songs-height/

Financial Performance

HBL Power Systems grew healthily as it met demand in the country and had export opportunities. Some highlights of the financial performance of the company are,

Revenue Growth The company has witnessed a revenue growth from year to year. Its core business units-battery and power systems-have successfully contributed to the revenues.

Profit Margins: Despite capital-intensive nature of the business, HBL has managed to ensure a respectable margin on profitability owing to its lean operations and a strong focus on high-margin sectors like defense and railways.

Export Market: With a strong export presence in more than 80 countries, HBL has diversified revenue streams and has minimized dependence purely on the Indian market.

Future Growth Drivers

HBL Power Systems’ growth potential is being driven by several key factors:

- Electric Vehicle (EV) and Energy Storage: As the Indian government is pushing forward to encourage use of EVs and increase integration of renewable energy in the system, lithium-ion and lead-acid battery technology from HBL is poised to capitalise on it.

- Defense and Railways Contracts: Increased allocations to the defense budget in India and upgradation of the railway network should further provide HBL the long-term contracts and high-margin government projects.

- Renewable Energy Storage: The government’s renewable energy targets and incentives to solar and wind energy projects will increase the demand for HBL’s energy storage solutions.

Telecom Sector: Since India has initiated its 5G roll-out and telecom infrastructure is increasing in the country, the demand for power solutions in terms of backup batteries and inverters will be higher.

Challenges and Risks

HBL Power Systems is no exception; it has its own set of problems.

Dependance on Raw Materials: The very nature of battery manufacturing requires critical raw materials and therefore an incidence of global supply chain disruption or price increase impacts profitability.

Competition: The lithium-ion battery market is increasingly becoming competitive with domestic as well as international players entering the competition.

Technological Disruptions: The rate at which the battery technology is improving demands constant and significant investments on R&D. Any lag in innovation could bring about a lose in HBL’s market share.

Investment View

Strategic presence in high-growth sectors has brought the company HBL Power Systems to the attention of investors. The solid fundamentals and the order book showing an improvement make it an attractive proposition for long-term investors. Growth enablers and factors are categorized into three main areas: strong revenue base, growth in the high-margin sectors, and high geopolitical demand in key exportable products.

Strong Revenue Base:

The diversified business of HBL ensures stability and a solid revenue base.

Renewable Energy Potential: India embracing renewable energy might open doors to the newest income streams for HBL’s cutting-edge battery storage solution.

Investors will be aware of its dependencies on raw material and competition. One can, therefore, track global trends concerning overall usage of the product in the market, evolution of related government policy, and HBL’s trend in quarterly performance to understand the trajectory.

HBL Power Systems is India’s leading battery and power systems company, with a diversified product portfolio, strategic focus on high-growth sectors, and synergies through their engagements in various critical sectors including defense and railways and foray into renewable energy and energy storage. Hence, this power company is well placed for future growth. As an investment bet on the industrial and energy landscape of India, HBL Power Systems is a very compelling opportunity for investors.

Considering this stock has a special value to those that are interested in companies in between the interplay of technological innovation and infrastructural growth. Investors seeking long-term investment opportunities can find a proper place for HBL Power Systems in their diversified portfolios; however, its financial performance and the advancement in technology would become of importance while HBL continues on its journey across the quickly changing energy map.